In this blog series, we’ll help you engage with employees about their benefits using month-by-month topics, along with messaging and ideas proven to grab attention. Plus, throughout the series, you’ll find downloadable templates and examples that save you the brain drain so you can get started quickly.

This blog issue focuses on August, but our downloadable calendar gives you a full 12 months of content.

Aug: Make Retirement Savings Irresistible (and Irrefutable)

A recent Bankrate study shows that 20% of employees dipped into retirement funds during the pandemic. For Gen Z, that number is 40%. People depend on employers to help them with financial wellbeing, and a financially secure future is a big piece of that. Here’s where you can step in with communications that educate and motivate employees to make the most of their retirement savings account.

According to recent research on workplace financial wellbeing, employees spend about nine hours of their workweek dealing with financial issues. One of the biggest stressors is not having enough savings for retirement. Offering a retirement savings plan is great, but explaining how easy it is to actually put money in it…that may convince them to look elsewhere for immediate money.

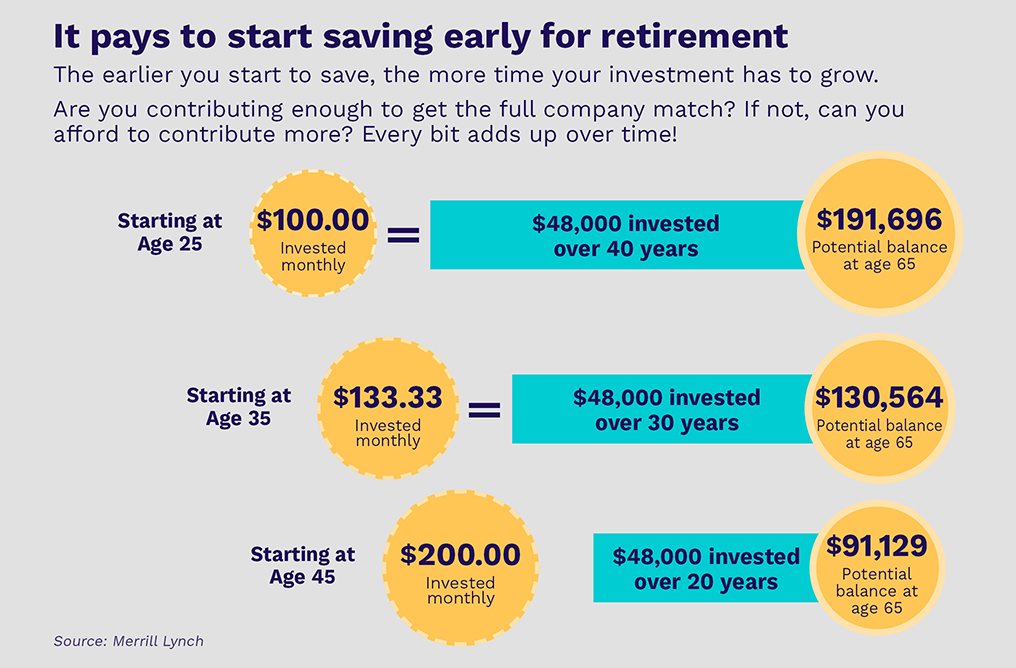

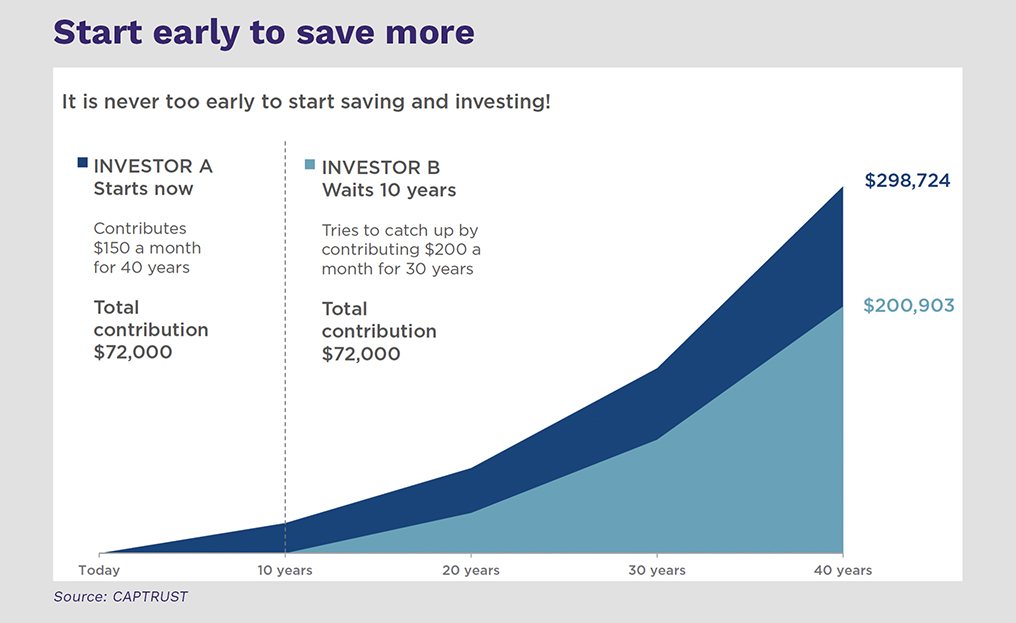

When an employee asks, “How much should I be saving for retirement,” these messages below can help spur discussions with visuals, numbers, and interactive tools.

“Step #1 in saving for retirement: Start!”

Send out communications targeting different age groups, because each group is motivated by different messaging.

- For 18-25: “It’s never too early to start saving.” Use a chart to show the importance of starting early, no matter the contribution level. Scroll down to see a couple examples.

- For 26-40: “Don’t ignore that practical voice in your head — you still have XX years to save.”

- For 41-65: “Strategies for saving in later years.” Plus, “Over 50? You can play catch-up.” The older people get, they’ll need additional tips for how to start saving more (cutting expenses, budgeting, etc.). Remember to promote the catch-up contribution for those over 50.

“If you’re not contributing X%, you’re leaving money on the table.”

Show the simple math on how to make the most of your company’s match. If it’s 6%, for example, employees should be contributing at least 6% of their own pretax money to get the full match. A simple table makes the point:

For employees with an HSA, remind them it’s also a valuable retirement tool. You can get tips on that messaging, too.

“How much will you need to retire?”

People love to see numbers and personal scores. Most 401(k) providers have extensive planning tools available. Employees can often get an overall retirement score, explore how much they need to retire, see their estimated retirement income, and much more.

If your provider doesn’t have such tools, Fidelity has plenty of free, public resources you can share.

Your EAP may offer financial counseling, either free or at a discounted rate. Be sure to promote this. Many employees think an EAP is only for mental health counseling.

Financial wellness benefits are at the top of employee wish lists, and planning for retirement is one of the biggest stressors in the workplace. Help them feel better about their future by helping them make the most of their retirement savings plan.

Stay tuned and watch for next month’s blog with tips on encouraging flu shots, and on how to get employees thinking about benefits well before Open Enrollment starts.

As we head through 2022, you can find other blogs in this series by typing “year-round calendar” in the search area at the top of our website.

Download the year-round communications calendar — real ideas and examples